Get the free payflex forms

Show details

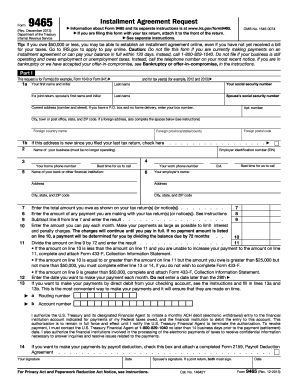

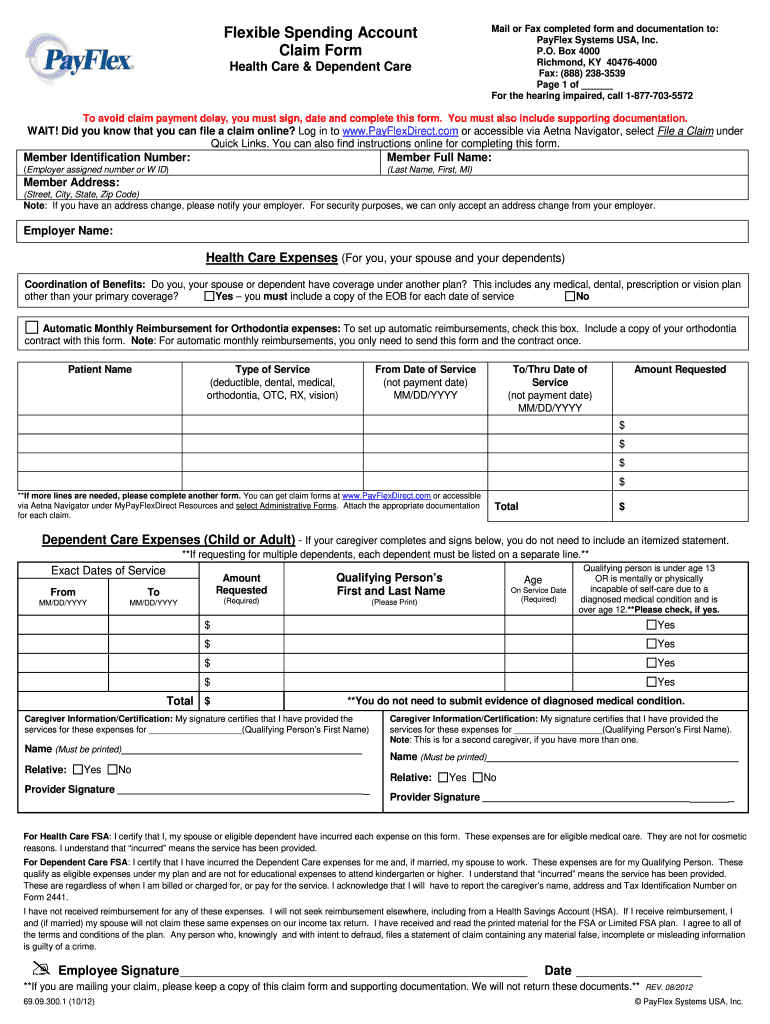

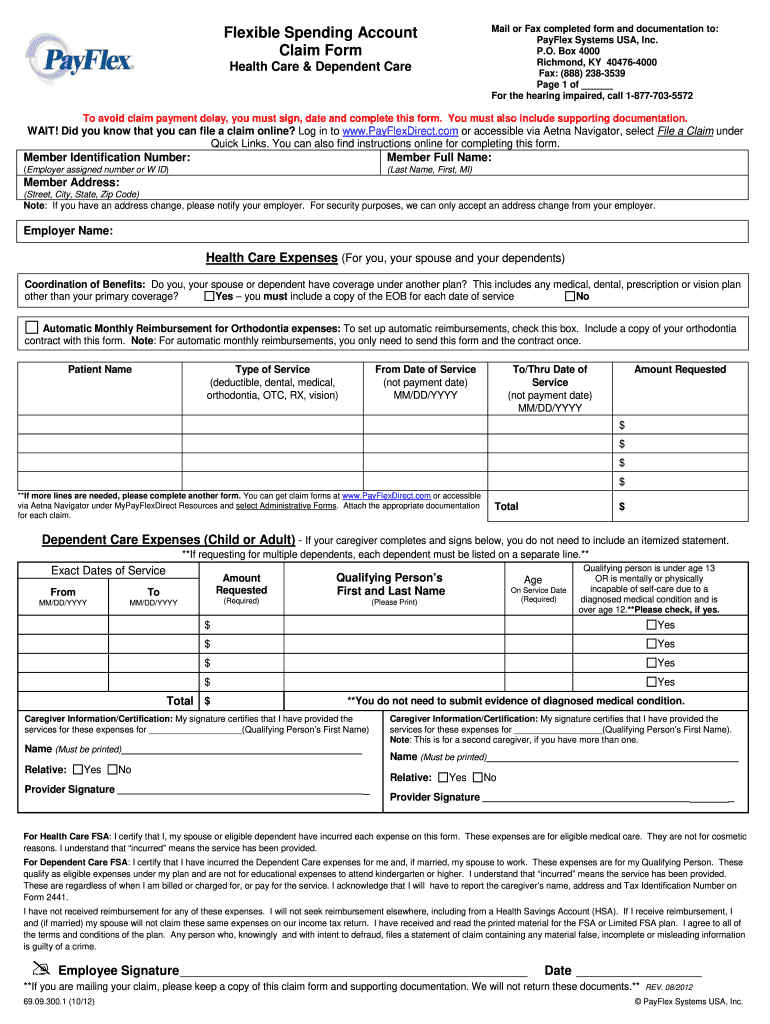

Mail or Fax completed form and documentation to PayFlex Systems USA Inc. P. O. Box 4000 Richmond KY 40476-4000 Fax 888 238-3539 Page 1 of For the hearing impaired call 1-877-703-5572 Flexible Spending Account Claim Form Health Care Dependent Care To avoid claim payment delay you must sign date and complete this form. You must also include supporting documentation. WAIT Did you know that you can file a claim online Log in to www. PayFlexDirect. com or accessible via Aetna Navigator select File...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your payflex forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payflex forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payflex forms online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payflex dependent care claim form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out payflex forms

How to fill out payflex forms:

01

Gather all necessary information and documents that may be required to fill out the forms, such as your personal identification details, bank account information, and any supporting documents.

02

Follow the instructions provided on the payflex forms carefully, ensuring that you understand each section and what information is required.

03

Begin by providing your personal details, including your full name, contact information, and social security number if applicable.

04

Continue filling out the forms by entering any relevant employment information, such as your employer's name, address, and employee identification number.

05

In some cases, you may need to specify the type of account or plan you are enrolling in or making changes to. Make sure to accurately select the appropriate option.

06

If you are making any contribution elections or changes to your account, clearly indicate the new contribution amount or percentage, if applicable.

07

Review all the information you have entered to ensure accuracy and completeness. Make any necessary amendments and corrections before submitting the forms.

08

Sign and date the payflex forms as required. Pay attention to any additional authorization sections that may need your signature.

09

Make copies of the filled-out forms for your records, and submit the original forms to the designated recipient, whether it be your employer, a third-party administrator, or the payflex company directly.

Who needs payflex forms:

01

Employees who are eligible to participate in an employer-sponsored benefit plan that is administered by payflex may need to fill out payflex forms.

02

Individuals who wish to enroll in or make changes to their account contributions, such as contributions to a flexible spending account or health savings account, may also need to complete payflex forms.

03

Employers who offer payflex-administered benefit plans to their employees will need to provide the necessary payflex forms to ensure proper enrollment, changes, or contributions are processed accurately.

Fill payflex flexible spending account claim form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payflex forms?

PayFlex Forms is an online form-building service that helps businesses create, manage, and deploy forms quickly and easily. It allows you to quickly build forms using drag-and-drop features, customize them with your brand colors and fonts, and embed them into websites or emails.

Who is required to file payflex forms?

The Internal Revenue Service (IRS) requires employers who offer employees the option to participate in a flexible spending account (FSA) to have the employees complete payflex forms. Employees are the ones responsible for completing the forms, which provide the necessary information to their employer about their FSA contributions.

How to fill out payflex forms?

1. Read the instructions on the form carefully before starting.

2. Enter your personal information including your name, address, contact number, and social security number.

3. Enter the employer's information including their name, address, and contact information.

4. Enter the amount you wish to contribute to your plan.

5. Select the type of contributions you wish to make: pre-tax, Roth, or after-tax.

6. Select the funds you wish to invest in and the amount you wish to allocate to each.

7. Sign and date the form.

8. Submit the form to your employer or Payflex account administrator.

What is the purpose of payflex forms?

Payflex forms are used to help employers and employees comply with federal tax laws when providing benefits through a cafeteria plan. They are used to track employee contributions to their cafeteria plan, as well as to document the employee's election of benefit choices.

What information must be reported on payflex forms?

Payflex forms typically require information related to an employee's personal and financial information such as name, address, Social Security number, bank account number, contributions made to their Payflex account, and employer identification number. Additionally, employers may require additional information such as the employee's job title, salary, and other employment-related information.

When is the deadline to file payflex forms in 2023?

The deadline to file PayFlex forms for the 2023 tax year will likely be in the spring of 2024. However, exact dates have not yet been announced.

What is the penalty for the late filing of payflex forms?

The penalty for the late filing of payflex forms varies depending on the particular type of form and the circumstances of the case. Generally, the penalty for late filing of payflex forms can include fines, interest charges, and other penalties as determined by the IRS.

How do I edit payflex forms online?

The editing procedure is simple with pdfFiller. Open your payflex dependent care claim form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in payflex dependent care form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing payflex reimbursement form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit dependent care fsa claim form payflex on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing payflex claim form.

Fill out your payflex forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payflex Dependent Care Form is not the form you're looking for?Search for another form here.

Keywords relevant to payflex documents and forms

Related to payflex claim form 2019

If you believe that this page should be taken down, please follow our DMCA take down process

here

.